If you’re looking to buy or sell a home, applying for a remortgage or are simply curious about where prices are heading, it’s never been easier to get an idea of price(s) online.

Our extended post on house valuation delves into the various free online tools that you can use for these purposes. But which one is the best and most accurate?

Most Accurate Home Value Website

The main property portals all use data from the HM Land Registry and therefore, in terms of accuracy, they’re all the same.

However, if you want to avoid using sites that have a vested interest in you actually selling your home, the HM Land Registry portal is the best site to use.

It’s essentially an online register of sold property and land in England and Wales. Conveyancing solicitors are legally required to submit the sale price of a property on completion, meaning that the data is completely accurate.

Royal Institute of Chartered Surveyors (RICS) professionals also use Land Registry data to assess current and future market trends as well as for Red Book valuation reports.

Note that it typically takes between 2 and 3 months for the register to be updated – with leasehold properties taking longer.

Using HM Land Registry to Get an Accurate Home Value

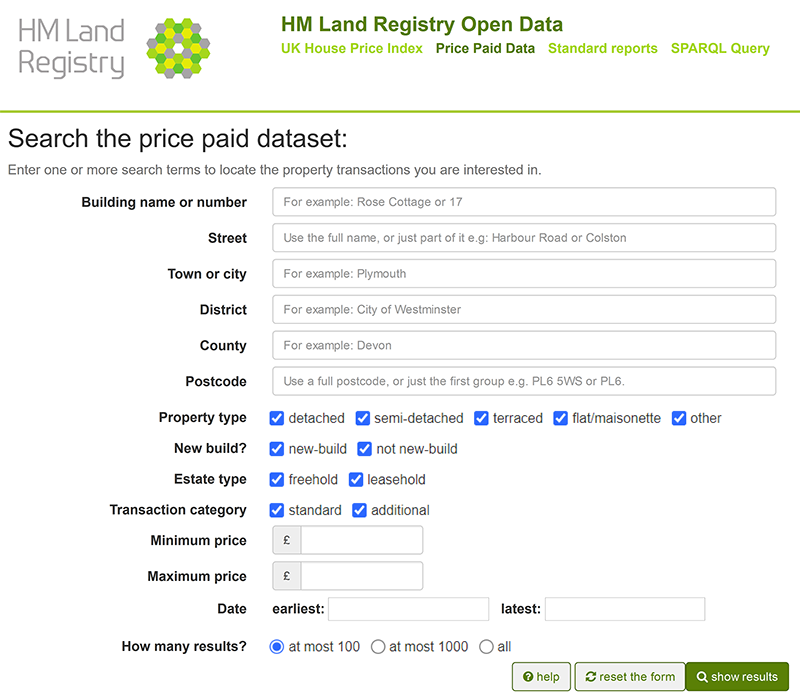

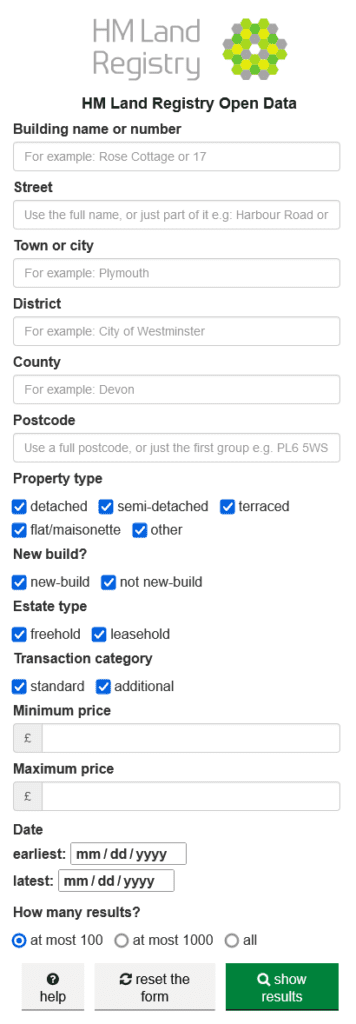

The HM Land Registry enables users to enter the details of a particular property into a form that looks like this:

Once the correct information has been entered and searched, you will be able to see the most recent price that was paid for any sold property.

You can use the tool to examine the details of surrounding homes for comparison or more recent data if required. You’ll also be able to see transactional history, property types, tenure type (freehold/leasehold) and whether the sold properties are new build (or not).

What’s more, there are additional tools available via the site that will allow you to:

- Search the UK House Price Index to discover house price trends across the country and

- Generate a report detailing average house prices in a specific area

Note that, if you have web development experience, you can also download and adapt house price data using a SPARQL query.

Expert Home Valuation Techniques

These days, it is absolutely possible to apply several techniques used by professional property valuers.

For instance, here’s a quick process you can use:

Use the HM Land Registry to discover the amount your property last sold for, and when.

Check the property sizes on the national Energy Performance Certificate register.

Search the surrounding area for more recent sales of similar properties.

Check out local trends using the UK House Price Index.

Seek out cached or “previously listed” local properties similar to yours on sites such as Rightmove and Zoopla. Although not always possible, you can discover information about their condition, layout and décor when last sold or let.

Check out Sold STC and Under Offer properties (also on portals like Rightmove and Zoopla). Note that these prices are by no means final (see recent asking vs. sold price differences in your area here).

Note that it is important to avoid totally relying on online data and your own estimates in order to generate an official valuation. The tools above are recommended for estimation purposes only.

Should You Ask an Estate Agent to Value Your Home?

Much will depend on your objectives. For instance, if you’re looking to sell on the open market, it’s worth asking a few estate agents for a valuation.

This service is usually free as these professionals hope that you will instruct their services. However, it’s a well-known fact that estate agents notoriously “massage the figures” to win business. However, having done your own research, you should be able to discern who to believe the most.

If you’re selling, feel free to request one of our free house valuation reports which contains the following:

- Breakdown of the last recorded sales price, estimated current open market value, equity level, price per m2/ ft2, Energy Performance Certificate rating;

- Comparable properties within 1/4 a mile;

- Essential data on the percentage asking price achieved upon sale / average sale time from initial listing to completion;

- House price trends at a county/regional level;

- Average prices of all residential properties sold over the most recently-tracked 12 month period in your postcode;

- Proportional split of different types of residential properties in your postcode;

- Sold prices flats, detached, semi-detached and terraced properties in your postcode over the last quarter;

- The percentage of sales within various price brackets of your property type over the last 12 months in your postcode;

- The average prices of properties of your type with the same number of bedrooms over the last 12 months in your postcode;

- Sales profiles of property sales of your tenure (freehold / leasehold) over the last 12 months;

- A whole page showing some of the recent sales in your postcode;

- The most and least expensive streets in your postcode over the last 5 years – including the approximate distance from your street.

When Should You Get an Independent Surveyor to Value Your Home?

You can usually rely on an independent RICS accredited surveyor to calculate a clear, unbiased valuation for any property. However, you will be required to pay a fee.

There are a number of reasons why you may want to go ahead, including:

- Your property is remote or unique and/or very difficult to ascertain its true open market value;

- You need a professional valuation for equity release, probate or other business requirements;

- The property needs a lot of refurbishment work and you would like to see what kind of value is possible to add;

- A formal valuation has been requested as part of a planning consent application;

- You simply want to show prospective home buyers a true, non-biased valuation.

These surveys / valuations usually start at around £300 and may reach £1,500, depending on the size and complexity of the property and the eventual value.